Get Free Consultation!

We are ready to answer right now! Sign up for a free consultation.

I consent to the processing of personal data and agree with the user agreement and privacy policy

We are ready to answer right now! Sign up for a free consultation.

I consent to the processing of personal data and agree with the user agreement and privacy policy

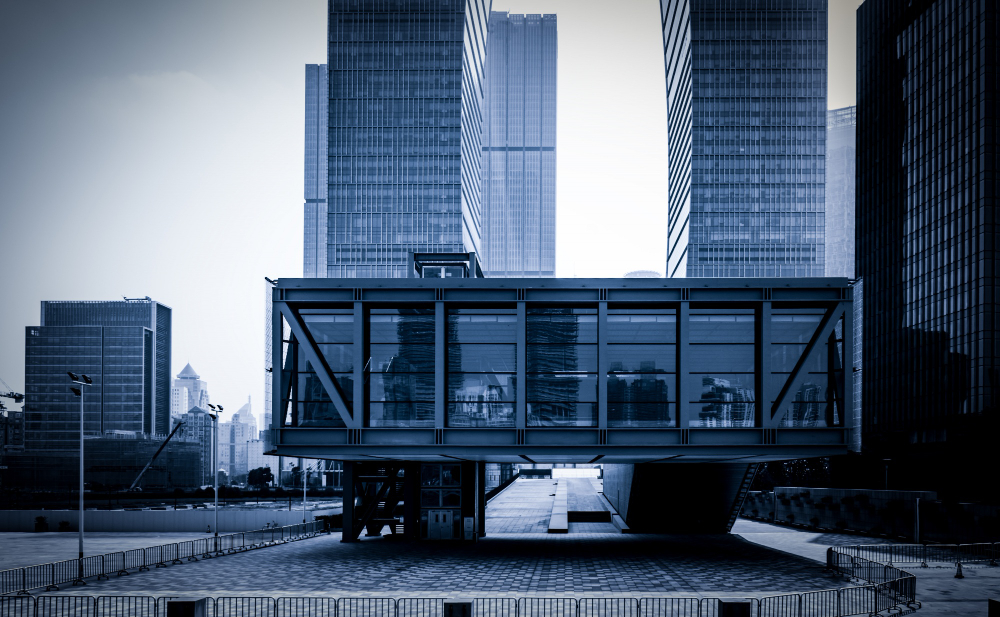

Dubai’s commercial real estate market is highly dynamic, offering various fractional ownership opportunities that cater to investors looking to diversify their portfolios. Here, we explore the most popular fractional ownership opportunities for high-end commercial properties in Dubai, along with their average prices.

High-end office spaces located in prime business districts such as Business Bay, Dubai Marina, and Downtown Dubai. These areas like Office Space for Rent in Business Bay Dubai are known for their modern infrastructure, connectivity, and presence of multinational corporations.

Average Price per Fractional Share: AED 2 million to AED 5 million

Features:

Luxury retail units situated in areas like The Dubai Mall, Ibn Battuta Mall, and Dubai Festival City. These locations Retail Space for Rent in Dubai South (Dubai World Central) attract a large number of visitors, making them ideal for retail businesses.

Average Price per Fractional Share: AED 3 million to AED 7 million

Features:

Fractional ownership in luxury hotel rooms, often managed by international hotel chains. These opportunities allow investors to share the ownership of hotel rooms, which can be used for personal stays or rented out.

Average Price per Fractional Share: AED 1.5 million to AED 4 million

Features:

High-end commercial suites designed for professional use, Commercial Property for Leasing and Renting in Jumeirah Village Triangle Dubai often located in prestigious business towers. These suites are ideal for small businesses and startups.

Average Price per Fractional Share: AED 1.8 million to AED 4.5 million

Features:

High-end industrial spaces suitable for manufacturing, warehousing, and logistics operations. These properties are often located in industrial zones with good infrastructure and connectivity.

Average Price per Fractional Share: AED 1.2 million to AED 3.5 million

Features:

Conclusion

Dubai’s commercial real estate market offers a variety of fractional ownership opportunities that cater to different investment preferences and goals.

Whether it’s office spaces, retail units, hotel rooms, commercial suites, or industrial spaces, investors can choose the option that best fits their investment strategy.

With average prices ranging from AED 1.2 million to AED 7 million per fractional share, these opportunities provide a flexible and lucrative way to invest in Dubai’s thriving commercial property market.